Interest and Principal Payments with Different Periodicity

By Samir Dube

Jul 24, 2002, 18:32

Many variable rate bond issues pay interest on a periodic schedule that does not coincide with maturing principal. For example, we may have a bond issue that is:

Example:

Dated & Delivered: January 1, 2002

Interest: Pays Quarterly beginning April 1, 2003

Principal: Pays Annually from December 1, 2003 - 2020

Overview:

To set this transaction up in Munex, you will need to initially set up the date and term as if it was a normal bond issue with a first coupon date of 3/1/03. This initial date coincides with the principal payment dates and allows us to enter our assumptions normally.

However, we need to tell Munex of the real interest payments dates. To do this, we will modify the Date and Term assumptions and then have the opportunity to enter the actual interest payment dates.

Walkthrough:

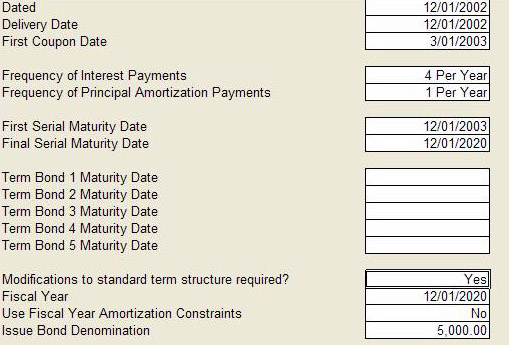

I. Go to Input - Date & Term.

a. Set the first coupon as 3/1/03

b. Set the interest frequency to 4 per year

c. Set the first serial maturity to 12/01/03

d. Set the final serial maturity to 12/01/20

e. Say YES to Modifications to standard term structures required?

f. Click OK

II. Modifications to Standard Term Stucture

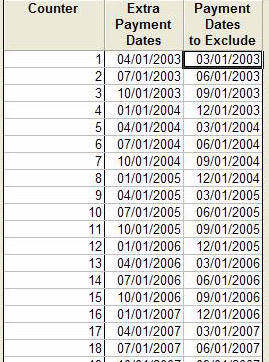

a. Click the Options button and select Add/Remove Interest Payment Dates

b. Under the remove column enter all the interest payments dates that we initially established

i. Enter 3/1/03 in the first row

ii. Highlight several cells in the column and click repeat

iii. Select quarterly

c. Under the add column enter the actual interest payment dates

i. Enter 4/1/03 in the first row

ii. Highlight several cells in the column and click repeat

iii. Select quarterly

Closing Remarks

Once you have completed this step, all you need to do is fill in the coupon and you are ready to solve. You will notice that whenever and principal matures (12/01) that some interest will be paid. The reason for this is the accrued interest on the principal maturing.

Email this article

Printer friendly page

|