|

|

|

|||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||

Search Site |

||

|

|

|||

Determining the Cost Effectiveness of Bond Insurance

|

|

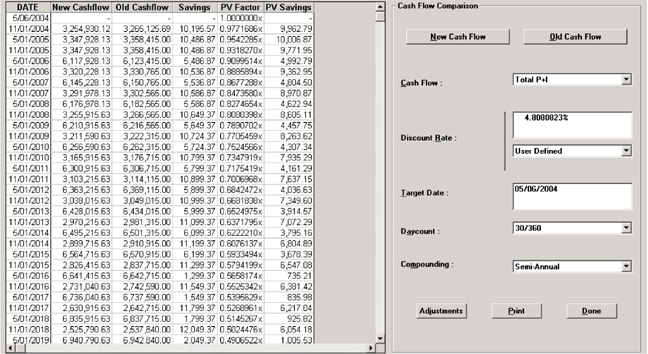

This report can be printed directly from the comparison utility by clicking the ‘Print’ button. Additionally, the report can be printed, along with other reports, from the normal print screen by clicking on File >> Print >> Aggregate >> Comparison.

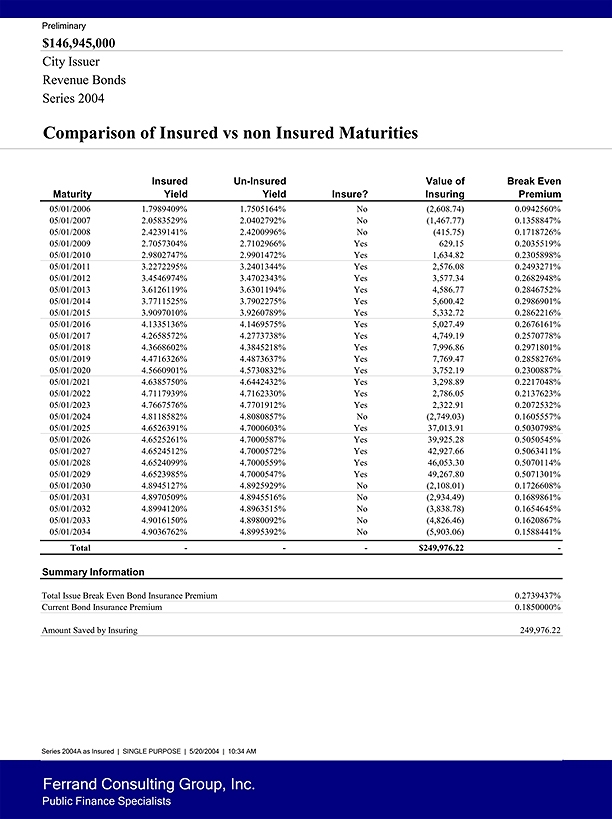

The Comparison of Insured vs. Uninsured Maturities report is accessed by going to File >> Print >> Expense >> 8 – Comparison of Insured vs. Uninsured. The first window prompts the user to select the Insured issue; the next screen asks for the Uninsured issue.

A more detailed explanation of terms follows, but the report provides a quick and simple indication in the ‘Insure?’ column of whether bond insurance is cost effective for the respective maturity. Additionally, the ‘Amount Saved by Insuring’ line item at the bottom of the report reflects the benefit of insuring the entire transaction.

|

Definitions

Maturity

Identifies the maturity being compared. To accommodate changes in par value between the Insured and Uninsured issues, the analysis by maturity is calculated on a per bond, or $5,000, basis.

Insured Yield

Identifies the Yield that equates the future value cash flows of one bond ($5,000) to the purchase price less the allocable insurance premium.

Uninsured Yield

Identifies the Yield that equates the future value cash flows of one bond to the purchase price. This typically corresponds closely to the yield displayed on the pricing summary report.

Insure?

Identifies whether the insurance premium is cost effective for the specified maturity. Essentially, indicates if the Uninsured yield is greater than the Insured Yield.

Value of Insuring

Applies the Uninsured Yield to the cash flow of the Insured maturity. From this present value figure we subtract the Insured maturity’s original dollar price less allocable insurance premium to derive the Value of Insuring.

Break Even Premium

Similar to ‘Value of Insuring’ above, the Uninsured Yield is applied to the total cash flow of the respective Insured maturity. The resulting present value figure is subtracted from the dollar price at issuance of the Insured maturity, which is then expressed as a percentage.

Total Issue Break Even Bond Insurance Premium

Takes the weighted average of the ‘Break Even Premium’ above to determine the issue level break even premium.

Current Bond Insurance Premium

The user-defined bond insurance premium.

Amount Saved by Inuring

Sum of ‘Value of Insuring’ column above.

| © Copyright 2018 Ferrand Consulting Group, Inc. | |||